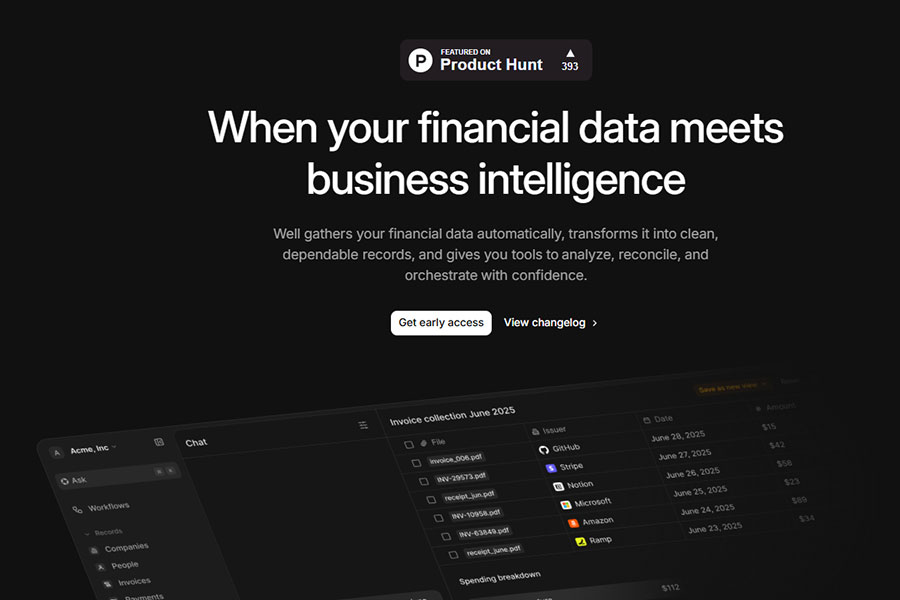

Well IntelligenceI

The AI Finance Assistant

The Modern Financial Stack for SMBs

Website:wellapp.ai

In the grand narrative of entrepreneurship, some scenes are universally similar: a weekend evening that should be spent with family turns into a struggle with chaotic invoices, unreconciled payment records, and confusing spreadsheets. This cost, silently borne by many founders but rarely spoken of, is known as the “Founder’s Tax”—your passion for innovation is quietly consumed by tedious financial operations.

But this “Sunday night accounting nightmare” must end. Now, an AI-driven solution named Well Intelligence is attempting to liberate founders from this chaos. It is not designed to add another management tool that needs maintenance, but rather to become a smart financial co-pilot with a deep understanding of your business, allowing you to regain clear insight into your financial data and absolute control over your precious time.

1. Well Intelligence: Detailed Introduction to the AI Tool

Well Intelligence is a generative finance engine officially launched by the Canadian startup Well on October 30, 2025. It avoids being “just another customizable dashboard” and instead directly pulls raw documents from over 120 everyday tools, including Gmail, WhatsApp, Stripe, Shopify, and domestic and international bank statements.

It uses a multi-modal large model to cleanse, reconcile, and categorize the data, then answers the questions founders care about most—”How much runway do I have left?” “By what percentage point has the burn rate changed this quarter year-over-year?” While answering, the system instantly generates accounting-compliant vouchers and board-ready charts, which can be pushed with one click to QuickBooks, Xero, or an auditor’s Google Drive.

Simply put, Well Intelligence positions itself as “the central data warehouse companies under 50 people have never had,” giving founders big-company-level financial intelligence for the first time without needing to hire an IT team.

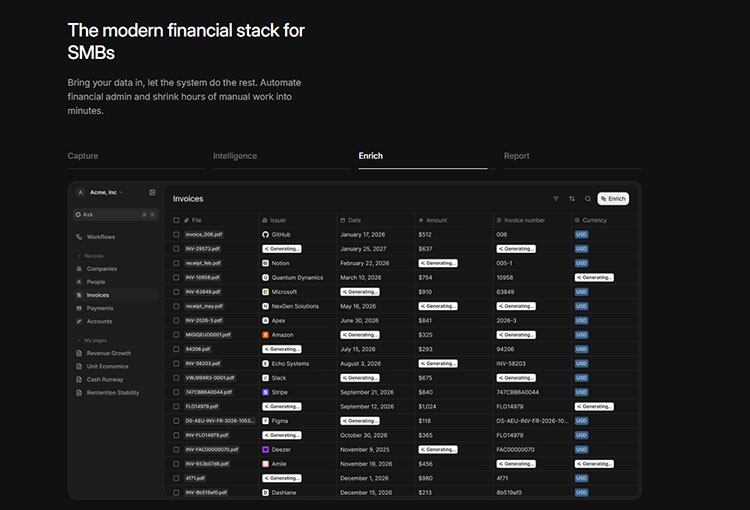

2. Specific Features of Well Intelligence

- Automatic Capture: Email, chat, portals, PDFs, scans, and mobile photos are jointly identified using OCR + LLM, achieving an accuracy rate of 99.2% (Well September 2025 internal audit report).

- Smart Q&A: Ask questions in natural language, and the system returns numbers, curves, attribution analysis, and labels the data source.

- Instant Reconciliation: Three-way comparison between Stripe receipts vs. bank deposits vs. invoicing records, highlighting discrepancies. A click generates an adjustment journal entry.

- Contextual Charts: One-click deployment of templates for fundraising scenarios, Unit Economics, SaaS Quick Ratio, etc. Chart formats are recognized by over 40 VCs as due diligence standard packages.

- Audit Trail: Every journal entry is accompanied by a “document snapshot + modification log + hash value,” complying with SOC-2 and the electronic voucher requirements of Schedule 9 of the Hong Kong Companies Ordinance.

- Collaboration Permissions: Three-tier permissions for founder, financial advisor, and external accountant, supporting Slack/Feishu bot subscription for critical metric anomaly alerts.

3. What is the Pricing for Well Intelligence?

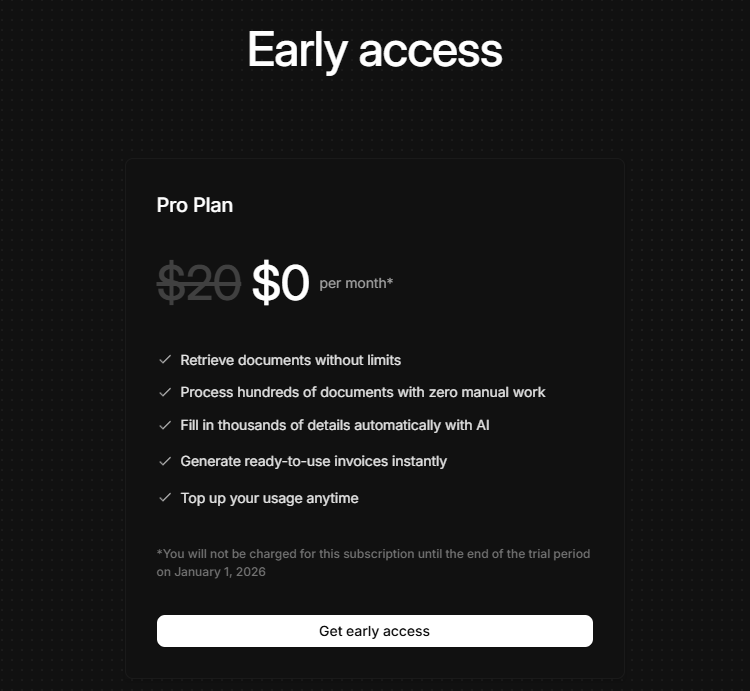

Currently, the official release is only offering an “Early Access Price”: the Pro Plan, originally $20/month, is dropped directly to $0 for early birds and remains free until January 1, 2026.

During the trial period, you can pull unlimited documents, have the AI automatically fill thousands of fields, and generate formal invoices with zero manual work. If usage exceeds the standard later, on-demand top-ups are supported without forced plan upgrades.

4. Who is the Target Audience for Well Intelligence?

The core audience is tech and e-commerce companies with 1–50 employees, an ARR under $20 million, and a fundraising stage between Pre-seed and Series A. Typical profiles include:

- SaaS teams whose founders still personally handle bank statements.

- DTC brands that outsource finance to a part-time CPA but don’t want to pay by the hour for every query.

- Mobile app companies planning to start due diligence within 6–12 months and need “clean data packages available anytime.”

If your company has already established an internal financial data warehouse and has dedicated data engineers, the marginal benefit from Well will decrease. However, if you prefer to use your valuable brainpower on product and market instead of Excel, Well Intelligence is an AI external aid almost custom-built for the “founder’s finance pain.”

Conclusion

From “Sunday accounting nightmare” to “Sunday chilling,” Well Intelligence uses automated capture, generative reconciliation, and natural language interaction to create the “financial intelligence hub” that small teams have always lacked, making it an instant plug-and-play cloud service. It won’t replace your accountant, but it will stop them from asking you for the fifth bank statement. Give Sundays back to life, and hand over financial decisions to AI—that is likely the final footnote Well Intelligence wants to write.